Abigail Lindsey worries the days of peace and quiet might be nearing an end at the rural, wooded property where she lives with her son. On the old ranch across the street, developers want to build an expansive complex of supercomputers for artificial intelligence, plus a large, private power plant to run it.

The plant would be big enough to power a major city, with 1,200 megawatts of planned generation capacity fueled by West Texas shale gas. It will only supply the new data center, and possibly other large data centers recently proposed down the road.

“It just sucks,” Lindsey said, sitting on her deck in the shade of tall oak trees outside the city of New Braunfels. “They’ve come in and will completely destroy our way of life: dark skies, quiet and peaceful.”

The project is one of many others like it proposed in Texas, where a frantic race to boot up energy-hungry data centers has led many developers to plan their own gas-fired power plants rather than wait for connection to the state’s public grid. Egged on by supportive government policies, this build out promises to lock in strong gas demand for a generation to come.

The data center and power plant planned across from Lindsey’s home is a partnership between an AI startup called CloudBurst and the natural gas pipeline giant Energy Transfer. It was Energy Transfer’s first-ever contract to supply gas for a data center, but not likely its last. In a press release, the company said it was “in discussions with a number of data center developers and expects this to be the first of many agreements.”

Previously, conventional wisdom assumed that this new generation of digital infrastructure would be powered by emissions-free energy sources like wind, solar, and battery power, which have lately seen explosive growth. So far, that vision isn’t panning out as desires to build quickly overcome concerns about sustainability.

“There is such a shortage of data center capacity and power,” said Kent Draper, chief commercial officer at Australian data center developer IREN, which has projects in West Texas. “Even the large hyperscalers are willing to turn a blind eye to their renewable goals for some period of time in order to get access.”

Dylan Baddour / Inside Climate News

IREN prioritizes renewable energy for its data centers—giant warehouses full of advanced computers and high-powered cooling systems that can be configured to produce crypto currency or generate artificial intelligence. In Texas, that’s only possible because the company began work here years ago, early enough to secure a timely connection to the state’s grid, Draper said.

There were more than 2,000 active generation interconnection requests as of April 30, totaling 411,600 MW of capacity, according to grid operator ERCOT. A bill awaiting signature on Gov. Greg Abbott’s desk, S.B. 6, looks to filter out unserious large-load projects bloating the queue by imposing a $100,000 fee for interconnection studies.

Wind and solar farms require vast acreage and generate energy intermittently, so they work best as part of a diversified electrical grid that collectively provides power day and night. But as the AI gold rush gathered momentum, a surge of new project proposals has created yearslong wait times to connect to the grid, prompting many developers to bypass it and build their own power supply.

Operating alone, a wind or solar farm can’t run a data center. Battery technologies still can’t store such large amounts of energy for the length of time required to provide steady, uninterrupted power for 24 hours per day as data centers require. Small nuclear reactors have been touted as a means to meet data center demand, but the first new units remain a decade from commercial deployment, while the AI boom is here today.

Now, Draper said, gas companies approach IREN all the time offering to quickly provide additional power generation.

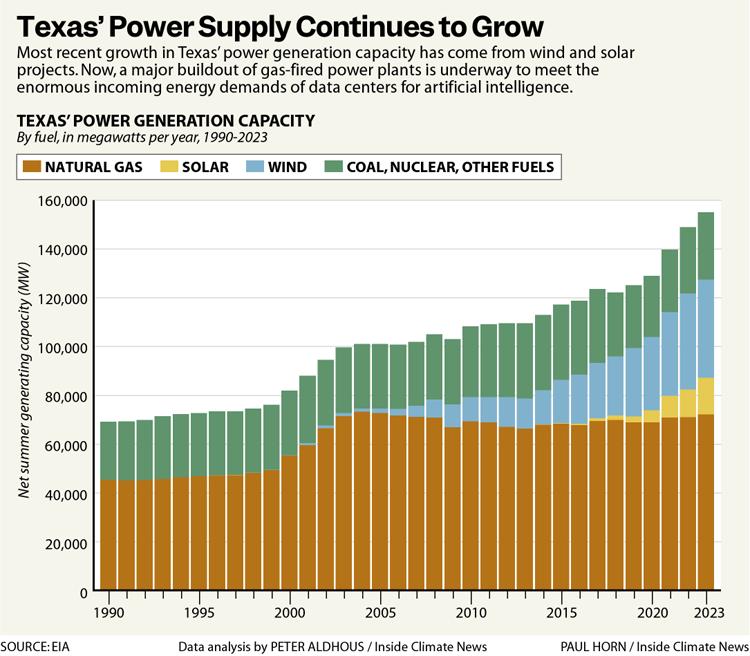

Gas provides almost half of all power generation capacity in Texas, far more than any other source. But the amount of gas power in Texas has remained flat for 20 years, while wind and solar have grown sharply, according to records from the U.S. Energy Information Administration. Facing a tidal wave of proposed AI projects, state lawmakers have taken steps to try to slow the expansion of renewable energy and position gas as the predominant supply for a new era of demand.

This build-out promises strong demand and high gas prices for a generation to come, a boon to Texas’ fossil fuel industry, the largest in the nation. It also means more air pollution and emissions of planet-warming greenhouse gases, even as the world continues to barrel past temperature records.

Texas, with 9 percent of the U.S. population, accounted for about 15 percent of current gas-powered generation capacity in the country but 26 percent of planned future generation at the end of 2024, according to data from Global Energy Monitor. Both the current and planned shares are far more than any other state.

GEM identified 42 new gas turbine projects under construction, in development or announced in Texas before the start of this year. None of those projects are sited at data centers. However, other projects announced since then, like CloudBurst and Energy Transfer outside New Braunfels, will include dedicated gas power plants on site at data centers.

For gas companies, the boom in artificial intelligence has quickly become an unexpected gold mine. U.S. gas production has risen steadily over 20 years since the fracking boom began, but gas prices have tumbled since 2024, dragged down by surging supply and weak demand.

“The sudden emergence of data center demand further brightens the outlook for the renaissance in gas pricing,” said a 2025 oil and gas outlook report by East Daley Analytics, a Colorado-based energy intelligence firm. “The obvious benefit to producers is increased drilling opportunities.”

It forecast up to a 20 percent increase in U.S. gas production by 2030, driven primarily by a growing gas export sector on the Gulf Coast. Several large export projects will finish construction in coming years with demand for up to 12 billion cubic feet of gas per day, the report said, while new power generation for data centers would account for 7 billion cubic feet per day of additional demand. That means profits for power providers, but also higher costs for consumers.

Natural gas, a mixture primarily composed of methane, burns much cleaner than coal but still creates air pollution, including soot, some hazardous chemicals, and greenhouse gases. Unburned methane released into the atmosphere has more than 80 times the near-term warming effect of carbon dioxide, leading some studies to conclude that ubiquitous leaks in gas supply infrastructure make it as impactful as coal to the global climate.

Dylan Baddour / Inside Climate News

It’s a power source that’s heralded for its ability to get online fast, said Ed Hirs, an energy economics lecturer at the University of Houston. But the yearslong wait times for turbines have quickly become the industry’s largest constraint in an otherwise positive outlook.

“If you’re looking at a five-year lead time, that’s not going to help Alexa or Siri today,” Hirs said.

The reliance on gas power for data centers is a departure from previous thought, said Larry Fink, founder of global investment firm BlackRock, speaking to a crowd of industry executives at an oil and gas conference in Houston in March.

About four years ago, if someone said they were building a data center, they said it must be powered by renewables, he recounted. Two years ago, it was a preference.

“Today?” Fink said. “They care about power.”

Gas plants for data centers

Since the start of this year, developers have announced a flurry of gas power deals for data centers. In the small city of Abilene, the builders of Stargate, one of the world’s largest data center projects, applied for permits in January to build 360 MW of gas power generation, authorized to emit 1.6 million tons of greenhouse gases and 14 tons of hazardous air pollutants per year. Later, the company announced the acquisition of an additional 4,500 MW of gas power generation capacity.

Also in January, a startup called Sailfish announced ambitious plans for a 2,600-acre, 5,000 MW cluster of data centers in the tiny North Texas town of Tolar, population 940.

“Traditional grid interconnections simply can’t keep pace with hyperscalers’ power demands, especially as AI accelerates energy requirements,” Sailfish founder Ryan Hughes told the website Data Center Dynamics at the time. “Our on-site natural gas power islands will let customers scale quickly.”

CloudBurst and Energy Transfer announced their data center and power plant outside New Braunfels in February, and another company partnership also announced plans for a 250 MW gas plant and data center near Odessa in West Texas. In May, a developer called Tract announced a 1,500-acre, 2,000 MW data center campus with some on-site generation and some purchased gas power near the small Central Texas town of Lockhart.

Not all new data centers need gas plants. A 120 MW South Texas data center project announced in April would use entirely wind power, while an enormous, 5,000 MW megaproject outside Laredo announced in March hopes to eventually run entirely on private wind, solar, and hydrogen power (though it will use gas at first). Another collection of six data centers planned in North Texas hopes to draw 1,400 MW from the grid.

Angelina Marie / The Texas Tribune

Altogether, Texas’ grid operator predicts statewide power demand will nearly double within five years, driven largely by data centers for artificial intelligence. It mirrors a similar situation unfolding across the country, according to analysis by S&P Global.

“There is huge concern about the carbon footprint of this stuff,” said Dan Stanzione, executive director of the Texas Advanced Computing Center at the University of Texas at Austin. “If we could decarbonize the power grid, then there is no carbon footprint for this.”

However, despite massive recent expansions of renewable power generation, the boom in artificial intelligence appears to be moving the country farther from, not closer to, its decarbonization goals.

Restrictions on renewable energy

Looking forward to a build out of power supply, state lawmakers have proposed or passed new rules to support deployment of more gas generation and slow the surging expansion of wind and solar power projects. Supporters of these bills say they aim to utilize Texas’ position as the nation’s top gas producer.

Some energy experts say the rules proposed throughout the legislative session could dismantle the state’s leadership in renewables as well as the state’s ability to provide cheap and reliable power.

“It absolutely would [slow] if not completely stop renewable energy,” said Doug Lewin, a Texas energy consultant, about one of the proposed rules in March. “That would really be extremely harmful to the Texas economy.”

While the bills deemed as “industry killers” for renewables missed key deadlines, failing to reach Abbott’s desk, they illustrate some lawmakers’ aspirations for the state’s energy industry.

One failed bill, S.B. 388, would have required every watt of new solar brought online to be accompanied by a watt of new gas. Another set of twin bills, H.B. 3356 and S.B. 715, would have forced existing wind and solar companies to buy fossil-fuel based power or connect to a battery storage resource to cover the hours the energy plants are not operating.

When the legislature last met in 2023, it created a $5 billion public “energy fund” to finance new gas plants but not wind or solar farms. It also created a new tax abatement program that excluded wind and solar. This year’s budget added another $5 billion to double the fund.

Dylan Baddour / Inside Climate News

Among the lawmakers leading the effort to scale back the state’s deployment of renewables is state Sen. Lois Kolkhorst, a Republican from Brenham. One bill she co-sponsored, S.B. 819, aimed to create new siting rules for utility-scale renewable projects and would have required them to get permits from the Public Utility Commission that no other energy source — coal, gas, or nuclear — needs. “It’s just something that is clearly meant to kneecap an industry,” Lewin said about the bill, which failed to pass.

Kolkhorst said the bill sought to balance the state’s need for power while respecting landowners across the state.

Former state Rep. John Davis, now a board member at Conservative Texans for Energy Innovation, said the session shows how renewables have become a red meat issue.

More than 20 years ago, Davis and Kolkhorst worked together in the Capitol as Texas deregulated its energy market, which encouraged renewables to enter the grid’s mix, he said. Now Davis herds sheep and goats on his family’s West Texas ranch, where seven wind turbines provide roughly 40 percent of their income.

He never could have dreamed how significant renewable energy would become for the state grid, he said. That’s why he’s disappointed with the direction the legislature is headed with renewables.

“I can’t think of anything more conservative, as a conservative, than wind and solar,” Davis said. “These are things God gave us — use them and harness them.”